Automakers Are Embracing Extended-Range EVs—Will Consumers Follow?

Introduction

The automotive industry is undergoing a transformative shift as electric vehicles (EVs) continue to gain traction worldwide. However, while traditional battery electric vehicles (BEVs) offer numerous benefits, they also come with range limitations that can deter potential buyers. To address these concerns, automakers are increasingly turning to extended-range EVs (EREVs), a hybrid solution that combines the benefits of electric propulsion with a backup internal combustion engine (ICE) or range extender.

But the question remains: will consumers follow automakers in embracing this new technology? In this article, we will explore what extended-range EVs are, why automakers are investing in them, the challenges they face, and whether consumer demand will align with industry trends.

What Are Extended-Range EVs?

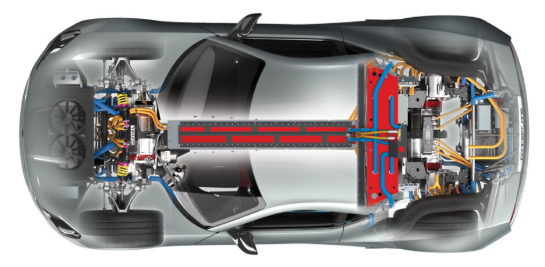

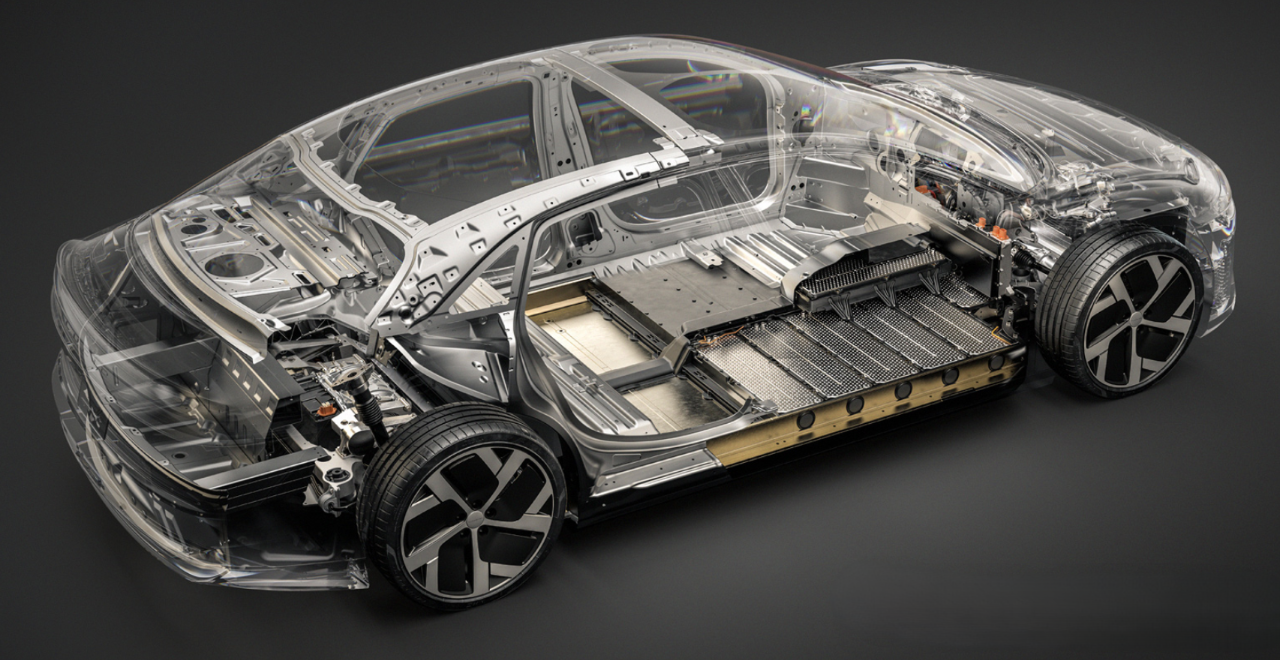

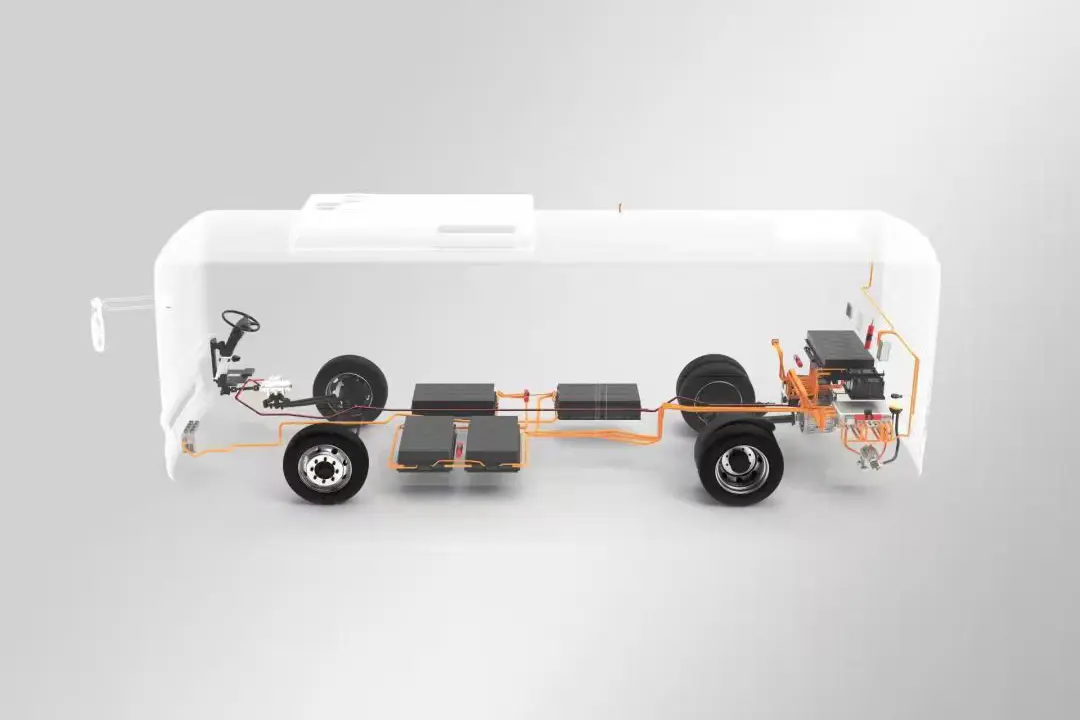

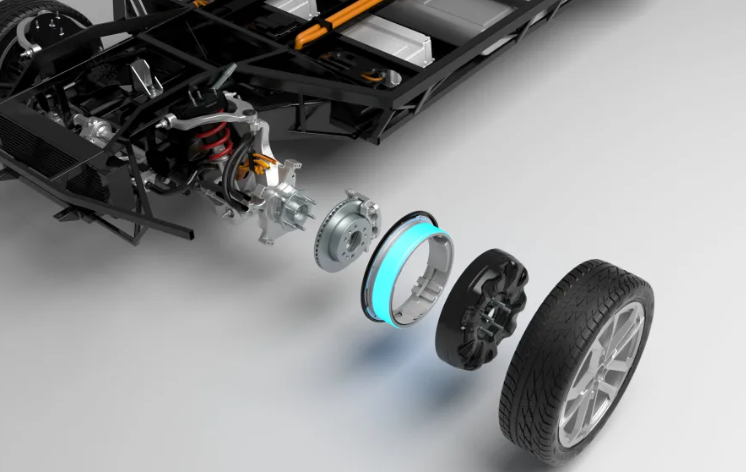

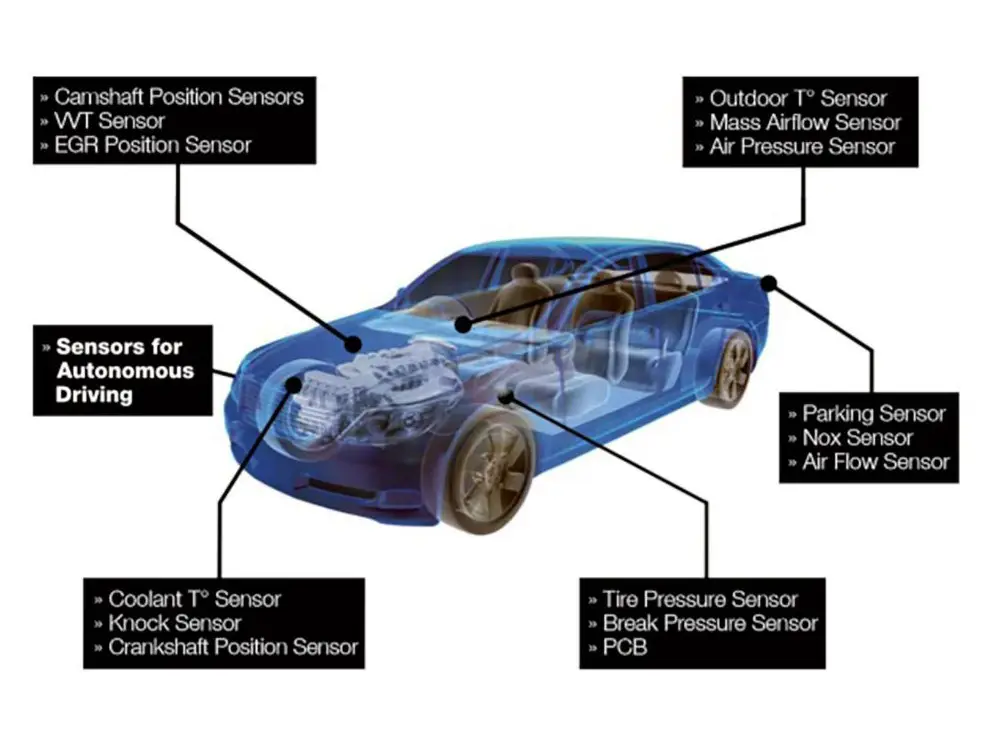

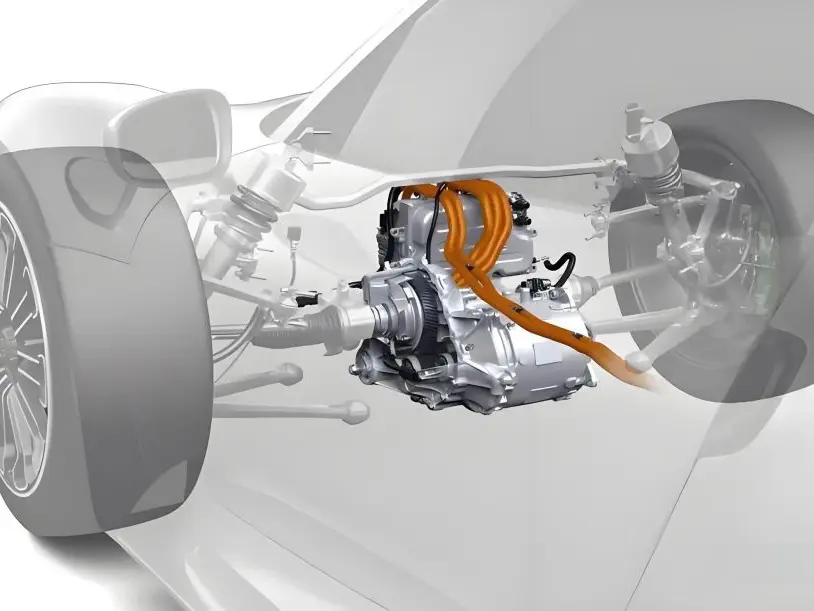

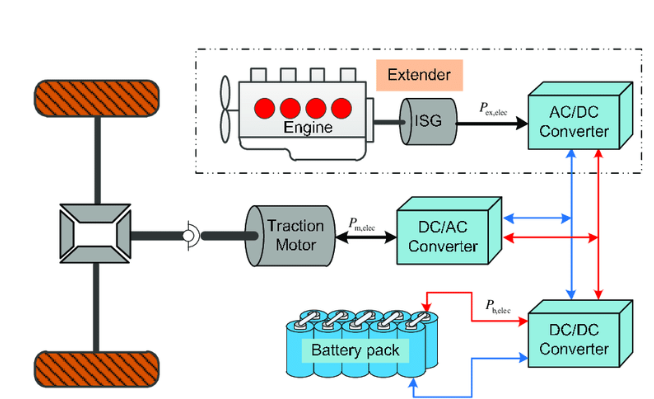

Extended-range electric vehicles (EREVs) are a type of plug-in hybrid electric vehicle (PHEV) designed to operate primarily on electricity while incorporating a small internal combustion engine or generator to extend the vehicle's range. Unlike conventional hybrids, which rely on a mix of electric and gasoline power, EREVs prioritize electric driving, with the gasoline engine serving only as a secondary power source when the battery is depleted.

Some key characteristics of EREVs include:

- Electric-First Operation: The vehicle runs on battery power until the charge is depleted, after which the range extender kicks in to provide additional mileage.

- Reduced Range Anxiety: Compared to traditional BEVs, EREVs offer greater flexibility for long-distance travel without requiring frequent charging stops.

- Lower Emissions than Conventional Vehicles: Because the primary power source is electricity, EREVs produce significantly lower emissions than traditional gasoline-powered cars.

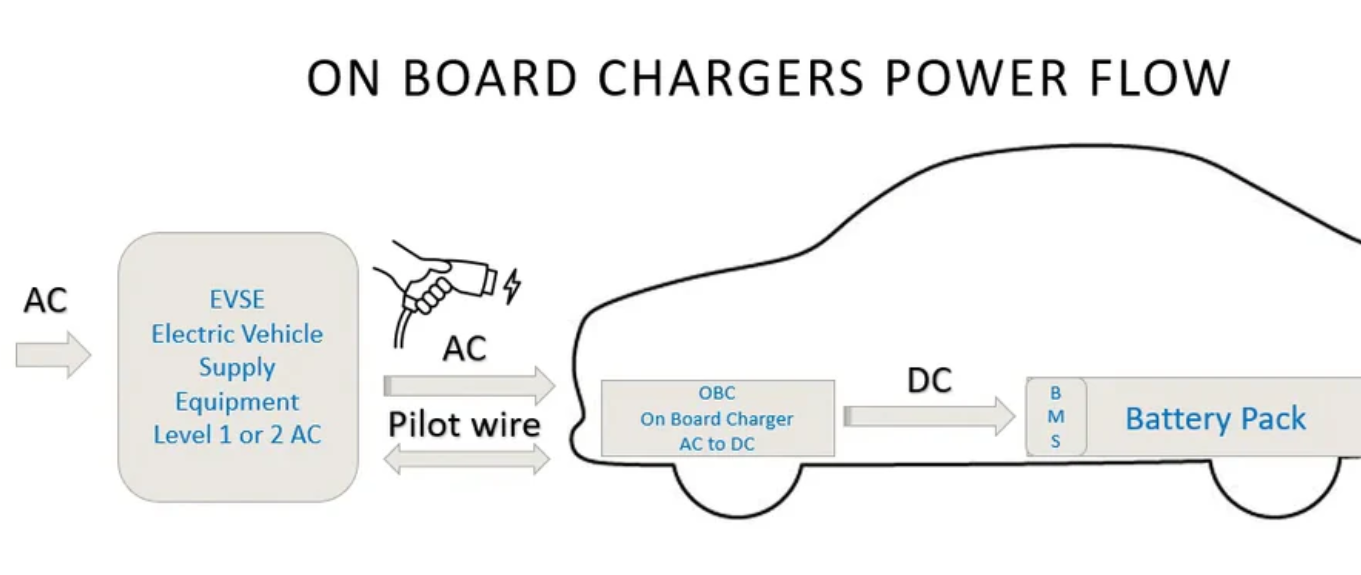

- Plug-in Charging: Like BEVs, EREVs can be recharged using an external power source, allowing for lower operating costs when using electricity.

Some well-known examples of extended-range EVs include the BMW i3 REx, Chevrolet Volt, and Karma Revero, each offering varying degrees of electric range before switching to gasoline support.

Why Automakers Are Investing in Extended-Range EVs

Automakers are pouring resources into extended-range EVs for several reasons, many of which stem from consumer concerns and market demands. Here are some of the primary drivers behind this shift:

1. Bridging the Gap Between BEVs and Traditional Vehicles

Many consumers remain hesitant to adopt fully electric vehicles due to range limitations and charging infrastructure constraints. EREVs serve as a compromise by offering electric driving with the reassurance of a gasoline backup. This makes them an attractive option for those who want to reduce emissions but are not yet ready to commit to a fully electric car.

2. Expanding EV Market Reach

Not all regions have developed charging infrastructures capable of supporting widespread BEV adoption. In rural areas or locations with harsh climates, EREVs offer a more practical solution. By providing a bridge between ICEs and BEVs, automakers can appeal to a broader audience.

3. Regulatory and Emission Standards

Governments worldwide are tightening emissions regulations, pushing automakers to innovate. While BEVs are the ultimate goal, EREVs provide an interim solution that allows automakers to comply with stringent emission laws while transitioning away from internal combustion engines.

4. Consumer Range Anxiety Concerns

One of the biggest barriers to BEV adoption is range anxiety—the fear of running out of battery before reaching a charging station. EREVs alleviate this concern, making them a more viable alternative for hesitant buyers who want electric vehicles but worry about charging availability.

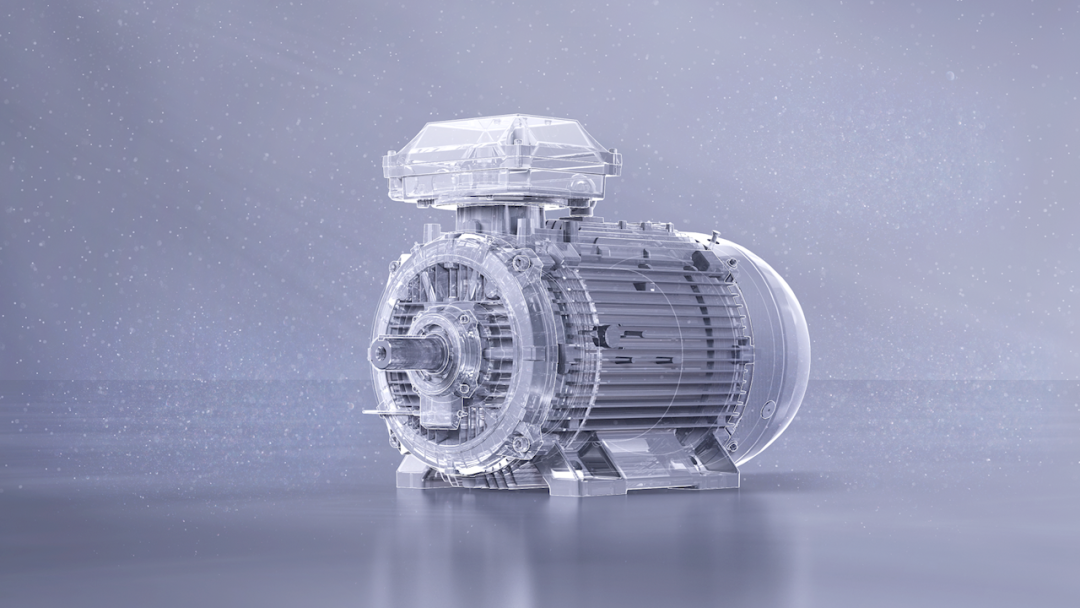

5. Leveraging Hybrid Technology Advances

Many automakers have already developed hybrid technology and can adapt it for use in EREVs. This reduces research and development costs while allowing them to introduce electrified models more quickly than if they were developing BEVs from scratch.

Reviving an Old Technology with New Appeal

The Chevrolet Volt, introduced in 2010 as General Motors' first modern venture into EV technology, was technically an extended-range electric vehicle (EREV), though it was marketed as a plug-in hybrid (PHEV). Around the same time, Jaguar planned to produce a limited run of its C-X75 concept car in 2013 but canceled the project due to the Great Recession. While a version of the C-X75 appeared in the James Bond film Spectre and a design firm later created a gas-powered variant, the model never entered full production. A few years later, BMW offered a range-extender option for its i3 EV, equipping it with a small generator to provide additional mileage in emergencies. However, according to Edmunds data, this feature failed to gain traction among consumers.

China played a pivotal role in reshaping the EREV landscape. In 2019, Chinese automaker Li Auto stood out globally by introducing the Li One, a range-extended SUV. At the time, EREVs accounted for just 1% of all PHEV sales, according to BloombergNEF. However, by 2023, Li Auto had propelled EREVs to claim 28% of the PHEV market share, representing 9% of all electric vehicle sales in China. While still a niche segment, this rapid growth has been "transformative in a pretty short amount of time," notes Corey Cantor, an electric vehicle analyst at BloombergNEF. The rest of the world may soon take note.

Challenges Facing Extended-Range EV Adoption

While EREVs offer several advantages, they also face significant challenges that could hinder widespread adoption.

1. Higher Costs Compared to ICE Vehicles

Extended-range EVs often come with a higher price tag than traditional gasoline-powered vehicles due to their dual powertrain system. The inclusion of both an electric battery and a gasoline generator adds to manufacturing costs, making them less accessible to budget-conscious consumers.

2. Complexity of Powertrain Systems

The dual-system design of EREVs means they require more complex engineering compared to either pure BEVs or conventional hybrids. This can lead to higher maintenance costs and potential reliability concerns, deterring some buyers who prioritize simplicity.

3. Limited Model Availability

Currently, the selection of extended-range EVs remains relatively limited compared to traditional BEVs or hybrids. As a result, consumers interested in purchasing an EREV may find their options restricted, leading them to choose either a BEV or a traditional hybrid instead.

4. Charging Infrastructure Development

Although EREVs reduce range anxiety, they still rely on charging infrastructure for optimal performance. In regions where public charging networks are sparse, consumers may opt for gasoline-powered vehicles or hybrids instead.

5. Environmental Concerns

While EREVs produce fewer emissions than conventional vehicles, they are not as environmentally friendly as fully electric cars. Some critics argue that investing in EREVs diverts resources from BEV development, slowing the transition to a zero-emission future.

Will Consumers Follow?

The ultimate success of extended-range EVs depends on consumer adoption. While these vehicles address several concerns associated with full electrification, their market acceptance will depend on several factors:

1. Pricing and Incentives

If governments and manufacturers provide financial incentives, such as tax credits and rebates, EREVs could become more attractive to cost-conscious buyers. Lowering initial purchase costs will be key in encouraging widespread adoption.

2. Public Awareness and Education

Many consumers still do not fully understand the benefits and differences between BEVs, hybrids, and EREVs. Automakers must invest in educating potential buyers on how EREVs function and how they can provide a balanced transition toward full electrification.

3. Charging and Fueling Convenience

Consumers prioritize convenience, and the ability to charge at home while having a backup gasoline option may appeal to many. If automakers and policymakers work to improve charging infrastructure while keeping fuel stations accessible, EREVs could see broader appeal.

4. Battery Technology Improvements

Advancements in battery technology could make EREVs more compelling. If automakers can extend the all-electric range while keeping costs down, EREVs may gain greater acceptance as a long-term solution rather than just a transitional one.

5. Environmental Consciousness

As sustainability becomes a more significant purchasing factor, consumers who want an environmentally friendly option without sacrificing practicality may gravitate toward EREVs. However, as BEVs become more efficient and infrastructure improves, EREVs may lose their appeal over time.

Conclusion

Extended-range EVs are emerging as a promising middle ground between traditional internal combustion engine vehicles and fully electric cars. Automakers are embracing this technology to address range anxiety, regulatory challenges, and consumer hesitations about BEVs. However, challenges such as cost, complexity, and limited model availability could hinder their adoption.

Whether consumers will follow automakers in embracing EREVs remains to be seen. Pricing incentives, education efforts, and infrastructure development will all play critical roles in shaping consumer behavior. As technology advances and the EV market evolves, extended-range EVs may serve as a stepping stone toward a fully electrified automotive future. The coming years will reveal whether EREVs become a long-term staple or simply a transitional phase in the electric revolution.

Read More: Top 10 EV Parts Manufacturers: The 2025 Guide